Why a Stock Peak Isn’t a Cliff

Posted on 13th October 2023

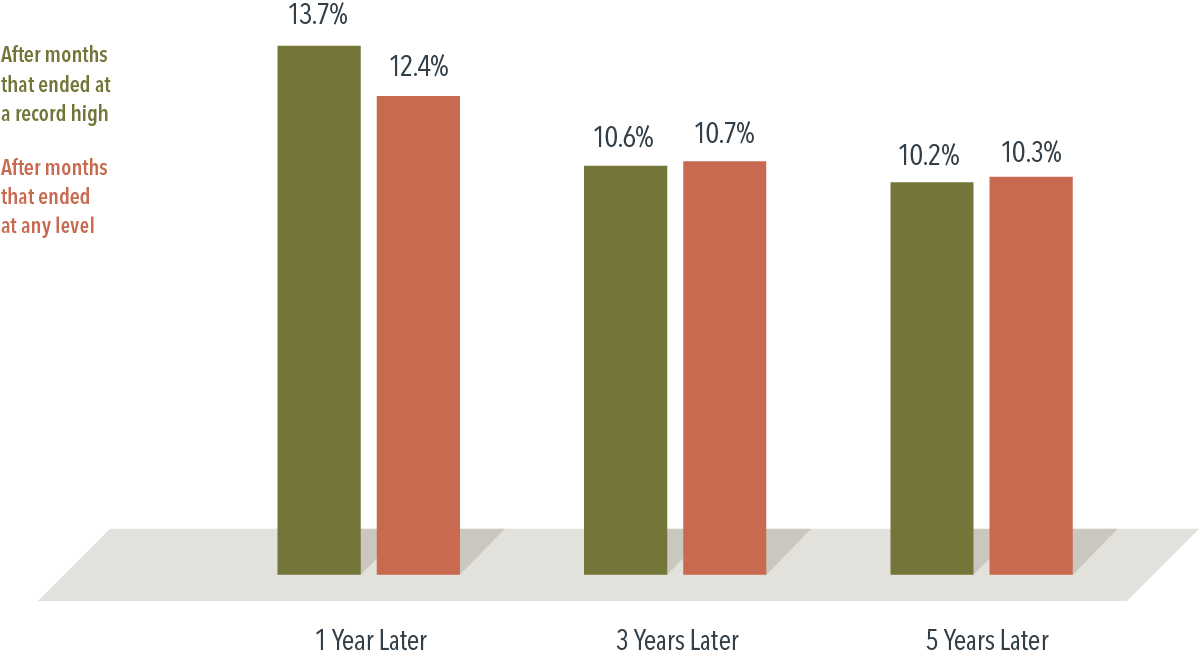

Many investors may think a market high is a signal stocks are overvalued or have reached a ceiling. But they may be surprised to find out that the average returns for the S&P 500 Index one, three, and five years after a new market high are similar to those after months that ended at any level.

In looking at all 1,000-plus monthly closing levels between 1926 and 2022 for the S&P 500 Index, 30% of the monthly observations were new market highs. After those highs, the average annualized compound returns ranged from almost 14% one year later to more than 10% over the next five years. Those results were close to average returns over any given period of the same length. When viewed in terms of the index simply having risen or fallen, the S&P 500 was higher a year after notching a record 81% of the time, and 86% of the time after five years.

Share this post: