The Next Blackberry?

Posted on 23rd February 2024

Some investors attribute the Magnificent 7 stocks’ dominance to a “winner-take-all” environment in which a handful of companies achieve sufficient market share to hinder competition. In businesses where gaining users drives success, establishing a strong market share may be like building a moat around profitability. But that doesn’t guarantee these companies can stay on top.

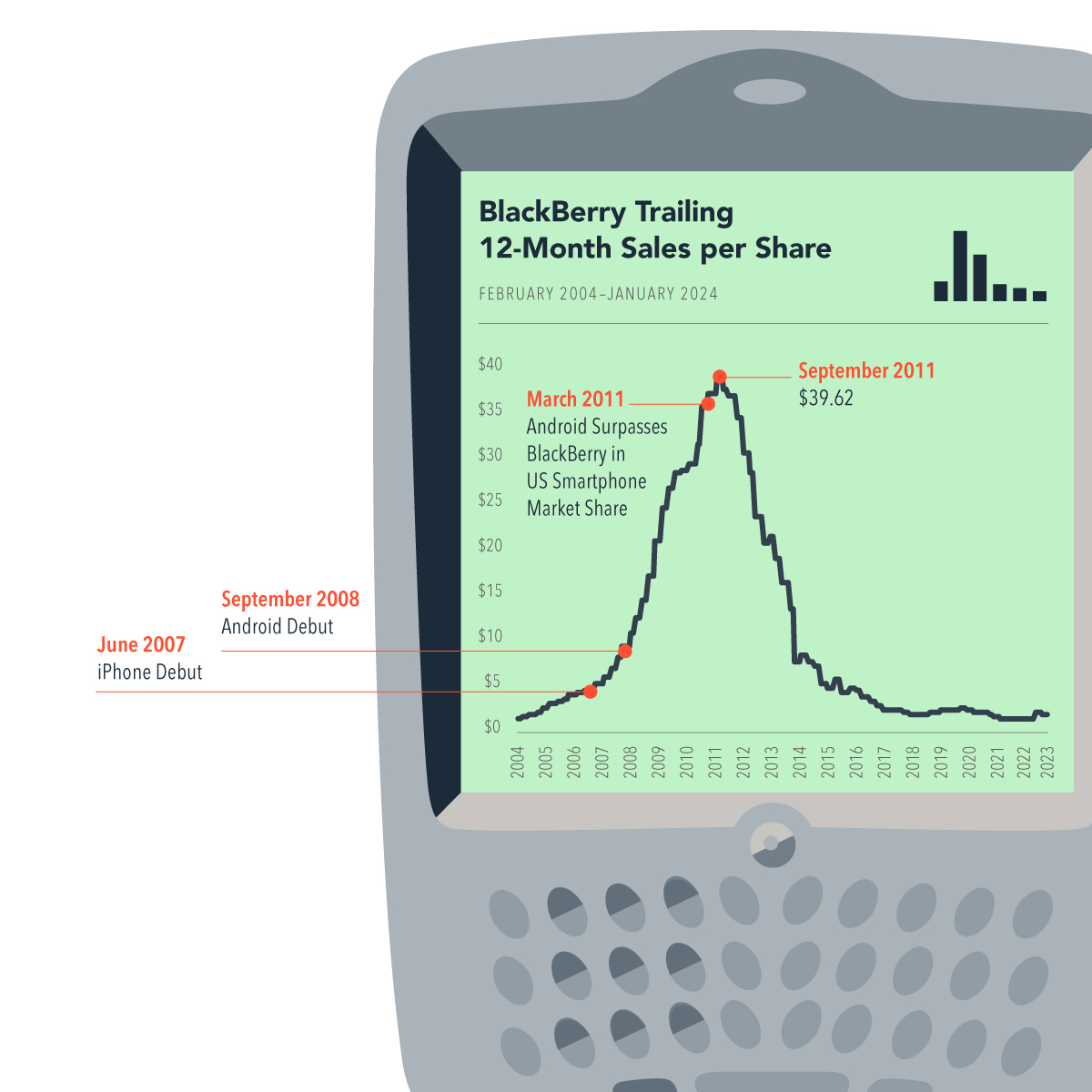

Think about the state of mobile phones 15 years ago. In all likelihood, you would have been reading this on a BlackBerry, such was that device’s entrenchment for mobile business communication. Then, along came iPhones and Androids and suddenly BlackBerry’s foothold was eroded.

History is littered with examples of household names that were usurped by the Next Big Thing. Remember, Sears was a Top 10-sized stock in the US once upon a time. AOL was synonymous with internet access in the 1990s. And in 2003, the most popular social media network starting with the letter F was Friendster.

Even the biggest companies have uncertain futures, highlighting the need for broadly diversified investments. And even if these companies stay at the top of the market, that’s no assurance higher returns will continue if their success is expected.

Share this post: