The Cost of Trying To Time the Market

Posted on 4th February 2022

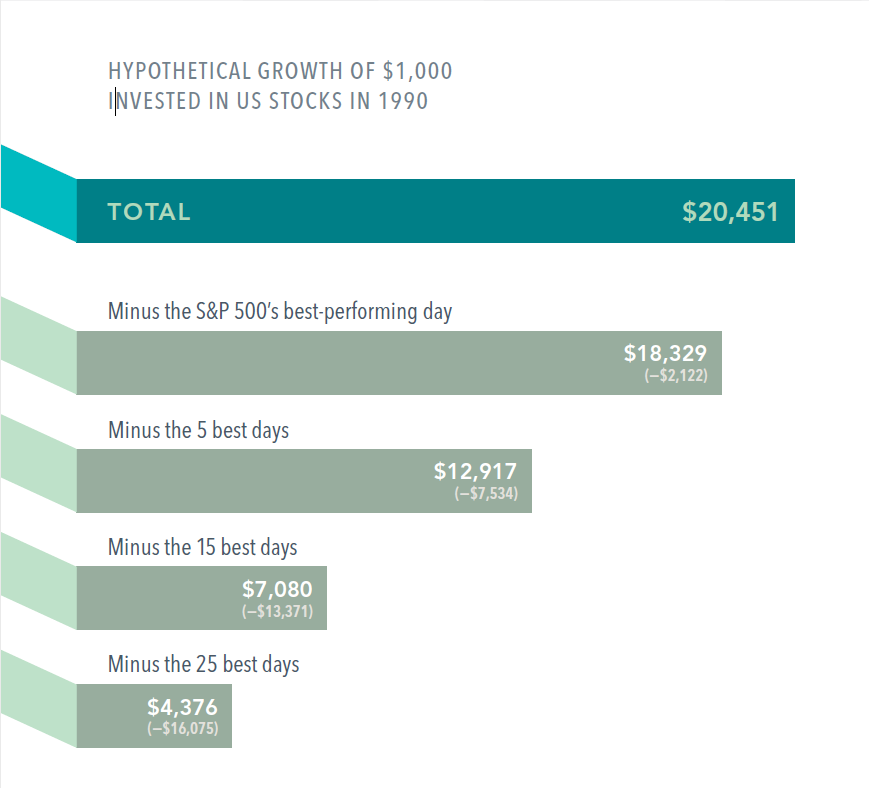

The impact of missing just a few of the market’s best days can be profound, as this look at a hypothetical investment in the stocks that make up the S&P 500 Index shows. Staying invested and focused on the long term helps to ensure that you’re in position to capture what the market has to offer.

A hypothetical $1,000 turns into $20,451 from 1990 through 2020.

Miss the S&P 500’s five best days and the return dwindles to $12,917. Miss the 25 best days and that’s $4,376.

There’s no proven way to time the market—targeting the best days or moving to the sidelines to avoid the worst—so history argues for staying put through good times and bad.

Missing only a few days of strong returns can drastically impact overall performance.

Share this post: