The 60/40 Portfolio: Down but Not Out

Posted on 31st October 2022

This has been a challenging year for investors. On top of the equity bear market, the steep losses in bonds1 have been especially surprising, leading some investors to question whether the classic 60/40 portfolio is dead.

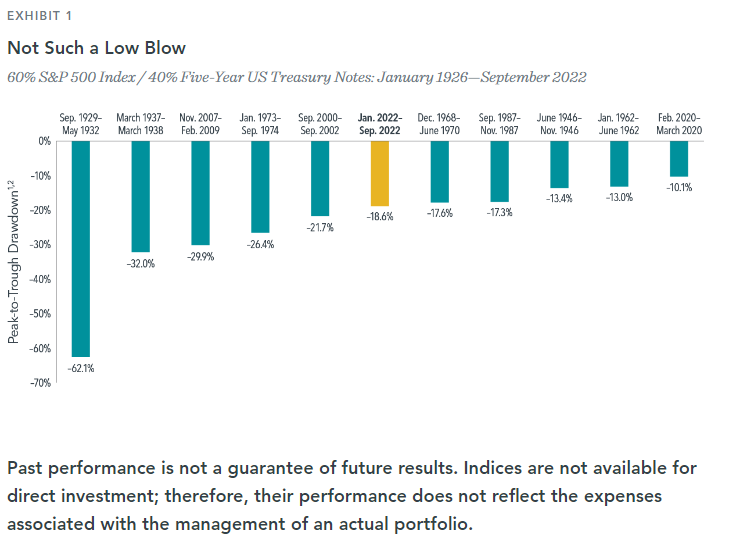

Although 2022 has seen the worst start to a year in history for many bond indices,1 the year-to-date experience for a 60/40 portfolio has not even cracked the top (or, alternatively, worst) five historical drawdowns of the last century. A 19% loss of wealth is not all that fun, but it’s only two-thirds of the drawdown investors endured through the financial crisis of 2008–2009 (see Exhibit 1).

A Case for Optimism

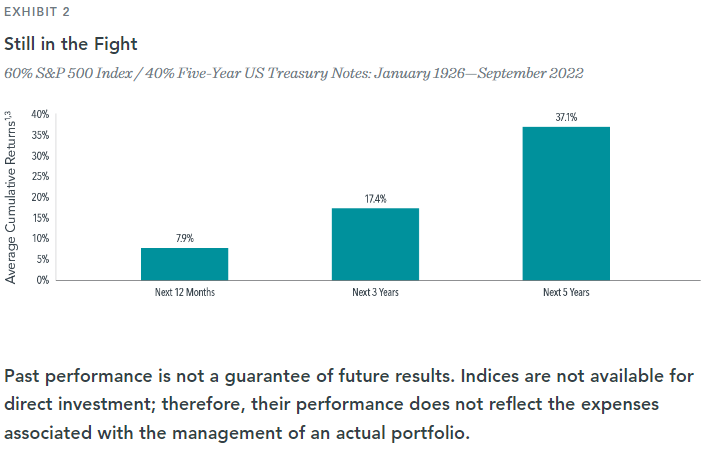

It is important, and especially so during difficult market conditions, for investors to focus not solely on where returns have been but also on where they could be going in the months and years ahead. Looking at the performance of a 60/40 portfolio following a decline of 10% or more since 1926 (see Exhibit 2), we see clearly that returns on average have been strong in the subsequent one-, three-, and five-year periods. History makes a strong case for investors to stick with their longer-term plan and should help serve as a reminder that steep declines shouldn’t derail investors’ progress toward reaping the expected benefits of investing.

Roll with the Punches

Markets have proven quite resilient over the long run. Like a boxer stepping inside the ring, investors should expect (and prepare) to take a few shots and get pushed up against the ropes every so often. The most important thing, though, is to roll with the punches and not get knocked out by short-term moves. If history is any guide, there’s reason to believe the classic 60/40 portfolio is alive and well and could be poised to deliver healthy returns going forward.

Share this post: