Rising Stocks Left Predictions Grounded

Posted on 26th January 2024

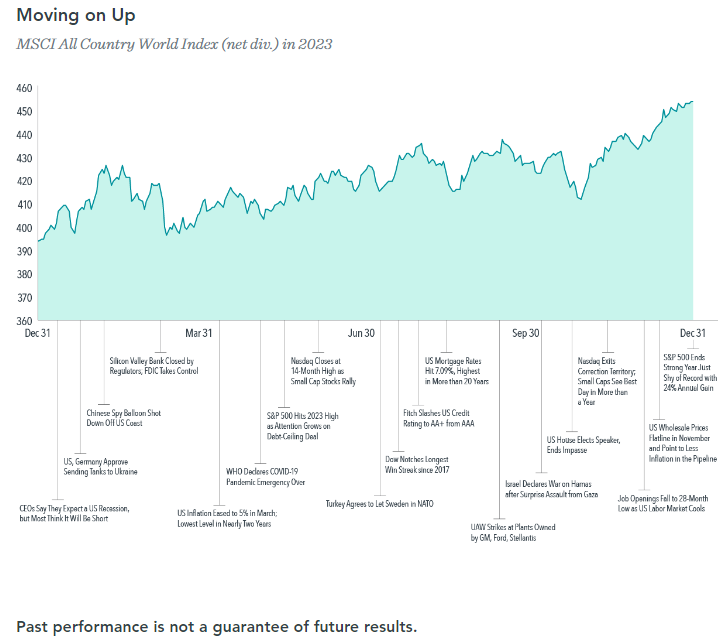

It was a year that defied expectations by many accounts. A number of forecasts predicted that the US economy would enter a recession in 2023 as the Federal Reserve raised interest rates to fight high inflation.

But the economy remained resilient, inflation eased, and the Fed declined to lift rates later in the year. US stocks rose in 2023, despite some setbacks along the way.1 Many economists who called for a recession have since walked back their predictions. This underscored that guessing where markets may be headed is not a reliable way to invest.

A year that many speculated would be lackluster for stocks saw the S&P 500 post gains of 19.2% on a total-return basis, extending a bull-market rally that began in 2022.2 Global stock markets also bounced back after posting their worst year since the financial crisis. Equities, as measured by the MSCI All Country World Index, rose 15.3% even as geopolitical tensions increased, with war continuing in Ukraine and hostilities erupting in the Middle East. Outside the US, developed stocks (represented by the MSCI World ex USA Index) added 11.3%, with the MSCI United Kingdom returning 7.7%. Emerging markets notched smaller gains, with the MSCI Emerging Markets Index up only 3.6%.

Share this post: