History Shows That Stock Gains Can Add Up After Big Declines

Posted on 12th July 2021

Sudden market downturns can be unsettling...

This content will only be shown when viewing the full post. Click on this text to edit it.

...But historically, US equity returns following sharp downturns have, on average, been positive.

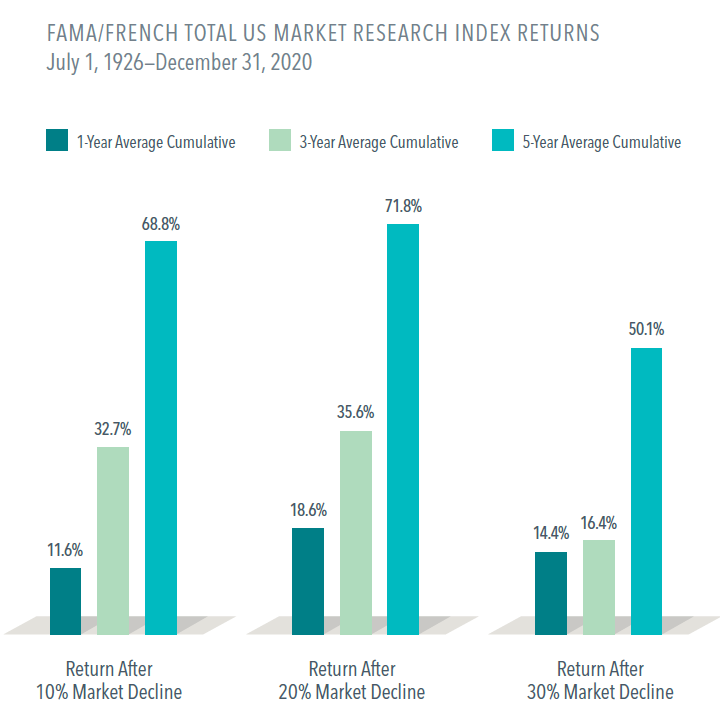

• A broad market index tracking data since 1926 in the US shows that stocks have tended to deliver positive returns over one-year, three-year, and five-year periods following steep declines.

• Cumulative returns show this to striking effect. Five years after market declines of 10%, 20%, and 30%,

the compounded returns all top 50%.

• Viewed in annualised terms across the longest, five-year period, returns after 10%, 20%, and 30% declines have been close to the historical annualised average over the entire period of 9.7%.

Sticking with your plan helps put you in the best position to capture the recovery.

Past performance is no guarantee of future results. Short-term performance results should be considered in connection with longer-term performance results.

Share this post: