Active Management Hasn’t Shined in Volatile Markets

Posted on 30th September 2022

Many investors have likely heard the adage that active management performs better in times of market turbulence.

Many investors have likely heard the adage that active management performs better in times of market turbulence. This may sound like an emotional hedge for market stress akin to betting against your favorite sports team to balance an adverse outcome with financial compensation. However, a historical analysis of active US-domiciled equity funds finds no meaningful relation between market volatility and managers’ success rates; the implication is that traditional active investments may compound your concerns during times of market uncertainty.

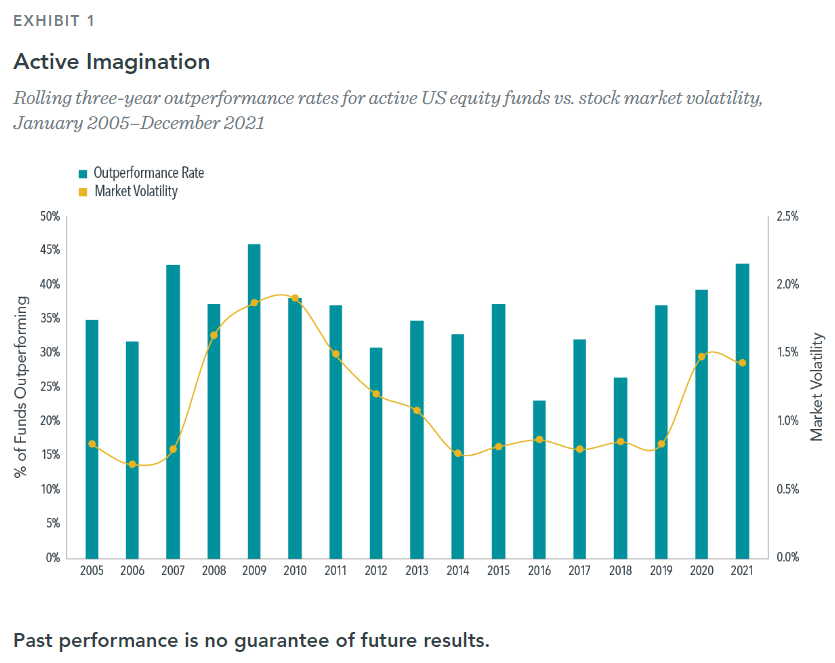

The rolling three-year standard deviation for US stock market returns, illustrated by the orange line in Exhibit 1, shows recent volatility has been at its highest since the 2008 financial crisis. Whether this portends success by active managers is doubtful. The rolling three-year outperformance rates by active US equity funds (blue bars) imply very little relation with volatility levels. The year-to-year variation in success rates does not consistently track market volatility. For example, rolling averages of daily volatility from 2014 to 2019 were consistent in level and yet the percent of funds outperforming during these rolling periods was not, ranging from 23% to 37%.

Volatile market environments give us enough to worry about–investors can do without unpredictable outcomes from traditional active management.

Share this post: