Trying to time the market

Posted on 5th April 2024

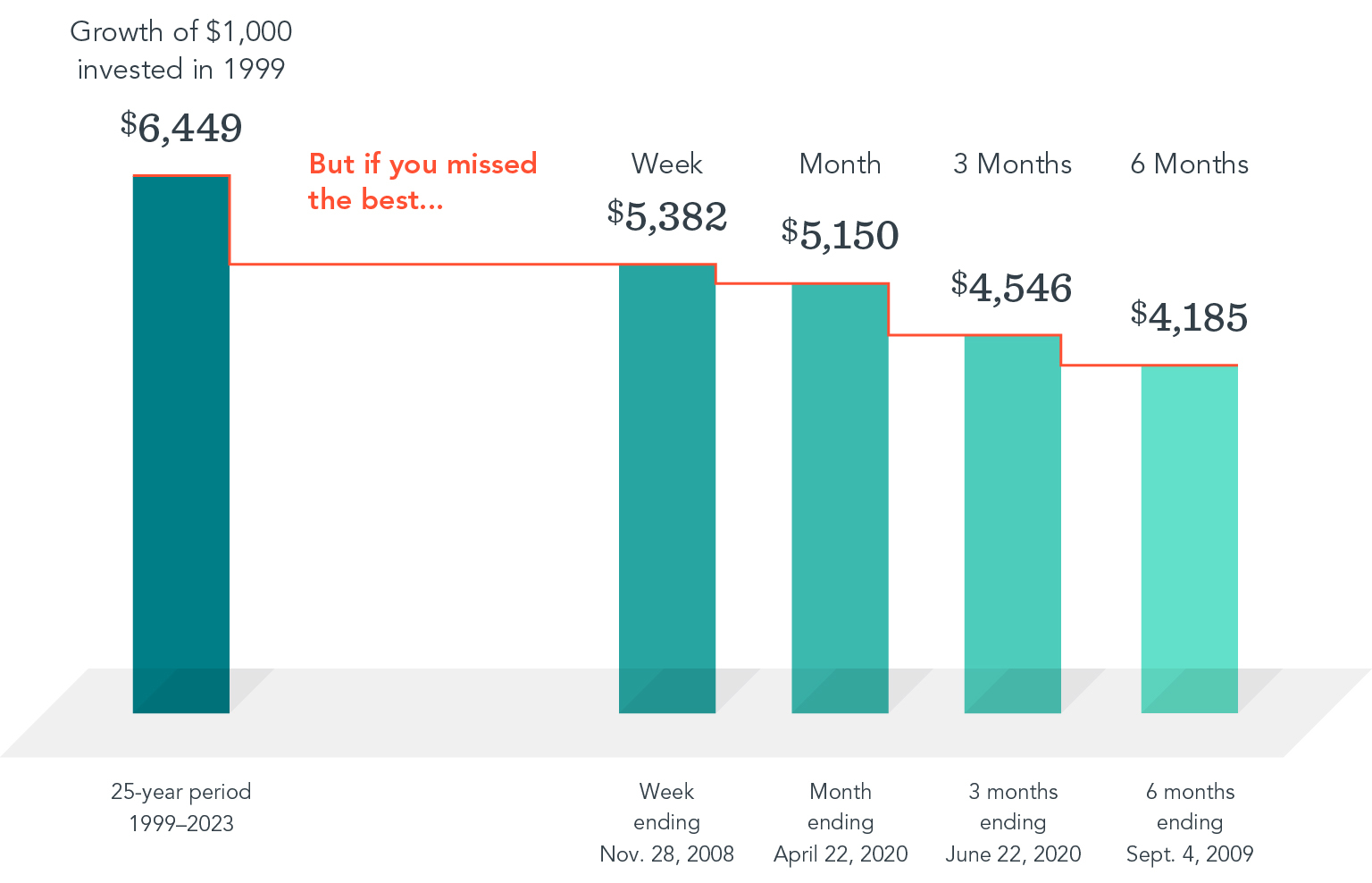

Investors may be tempted to cash out of the stock market to avoid a predicted downturn. But accurately forecasting the market’s direction to time when to buy and sell is a guessing game. Missing only a brief period of strong market performance can drastically affect your lifetime wealth.

For example, the chart below shows a hypothetical investment in the Russell 3000 Index, a broad US stock market benchmark. Over the entire 25-year period ending December 31, 2023, a $1,000 investment in 1999 turned into $6,449. But what if you pulled your cash out at the wrong time? Missing the best week, month, three months, or six months would have significantly reduced the growth of your investment.

Rather than trying to predict when stocks will rise and fall, investors can hold a globally diversified portfolio—and by staying invested, be better positioned to capture returns whenever and wherever they occur.

Share this post: