Bulls, Bears and Long-Term Benefits of Stock Investing

Posted on 7th September 2020

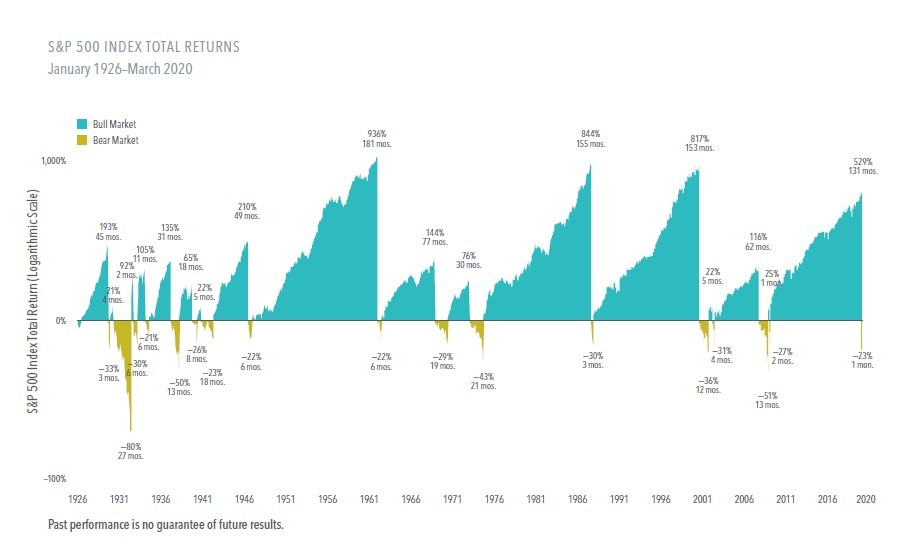

Stock returns are volatile, but nearly a century of bull and bear markets shows that the good times have outshined the bad times.

This content will only be shown when viewing the full post. Click on this text to edit it.

• From 1926 through March 31, 2020, the S&P 500 Index experienced 17 bear markets, or a fall of at least 20% from a previous peak. The declines ranged from —21% to —80% across an average length of around 10 months.

• On the upside, there were 17 bull markets, or gains of at least 20% from a previous trough. They averaged 56 months in length, and advances ranged from 21% to 936%.

• When the bull and bear markets are viewed together, it’s clear equities have rewarded disciplined investors.

The stock market’s ups and downs are unpredictable, but history supports an expectation of positive returns over the long term. For the best shot at the benefits the market can offer, stay the course.

Share this post: